Written by Malcom Rawls, Executive Director at RISE Memphis.

The financial challenges we face as a community aren’t going to disappear on their own. But together, we can ensure that Memphis becomes a city where financial literacy is the norm, not the exception.

Imagine working hard every day, doing everything “right,” yet still feeling like you’re one emergency away from financial disaster.

For many Memphis families, this isn’t just a fear; it’s their reality. With rising prices, increasing debt, and the ever-widening wealth gap, financial literacy is no longer just a “nice-to-have” skill. It’s a survival tool.

April is Financial Literacy Month, and while that might not sound as exciting as March Madness or Memphis in May, it’s one of the most important conversations we need to be having right now.

Why? Because financial literacy isn’t just about knowing how to balance a checkbook, it’s about empowering people to take control of their futures, break free from cycles of debt, and build wealth that lasts for generations.

The financial landscape: Why we’re in trouble

Right now, Americans are facing a financial crisis on multiple fronts. Inflation has made everything from groceries to gas more expensive. Credit card debt is at a record high, with many people using credit just to cover basic needs.

Student loan repayments have resumed, stretching budgets even thinner. And homeownership? It’s becoming more out of reach as housing costs skyrocket, making it nearly impossible for many hardworking families to buy a home and start building equity.

For Memphis, these challenges hit even harder. Our city has long battled economic disparities, with many of our residents lacking access to the financial education and resources needed to navigate these turbulent times.

Poverty and the lack of access to jobs with livable wages make financial stability an uphill battle for many families. Without real financial knowledge, people are left vulnerable—trapped in cycles of high-interest loans, paycheck-to-paycheck living, and financial instability that keeps them from ever getting ahead.

Financial literacy is the key to breaking the cycle

Here’s the good news: We can do something about this.

At RISE Memphis, we’ve seen firsthand how financial literacy changes lives. Take our Save Up program, which helps people build emergency savings. Participants who once had no financial cushion now have money set aside for unexpected expenses, giving them peace of mind and a pathway to financial stability.

One of our participants shared an inspiring story that proves just how powerful financial literacy can be:

“I purchased my home 12 years ago. The savings account I opened with RISE, I continued to save $100 a month, and with that money and interest from that account, my home is now paid off in full. If you need a volunteer or speaker about my journey, feel free to let me know.”

Another recent success story highlights the journey of a Memphis resident who came to the Greater Memphis Financial Empowerment Center (GMFEC) in 2023 after learning about the program at a local community event. She had always wanted to become a homeowner but knew she needed guidance to improve her credit score and reduce her debt.

After meeting with a financial counselor, she successfully paid off three out of four credit cards and significantly reduced her remaining balance. Her efforts paid off − her credit score increased by 40 points, reaching 700, and she received a lender’s approval to purchase a home with a closing date set for April 2025. She describes her financial journey best:

“Sometimes life throws you unexpected curveballs, it is up to us how we handle them.”

Stories like these prove that when people have the right knowledge and tools, they make better financial decisions that positively impact their lives and their communities.

Five things that need to happen next

So, where do we go from here? How do we make sure financial literacy isn’t just a conversation for one month a year but a permanent part of our city’s growth strategy?

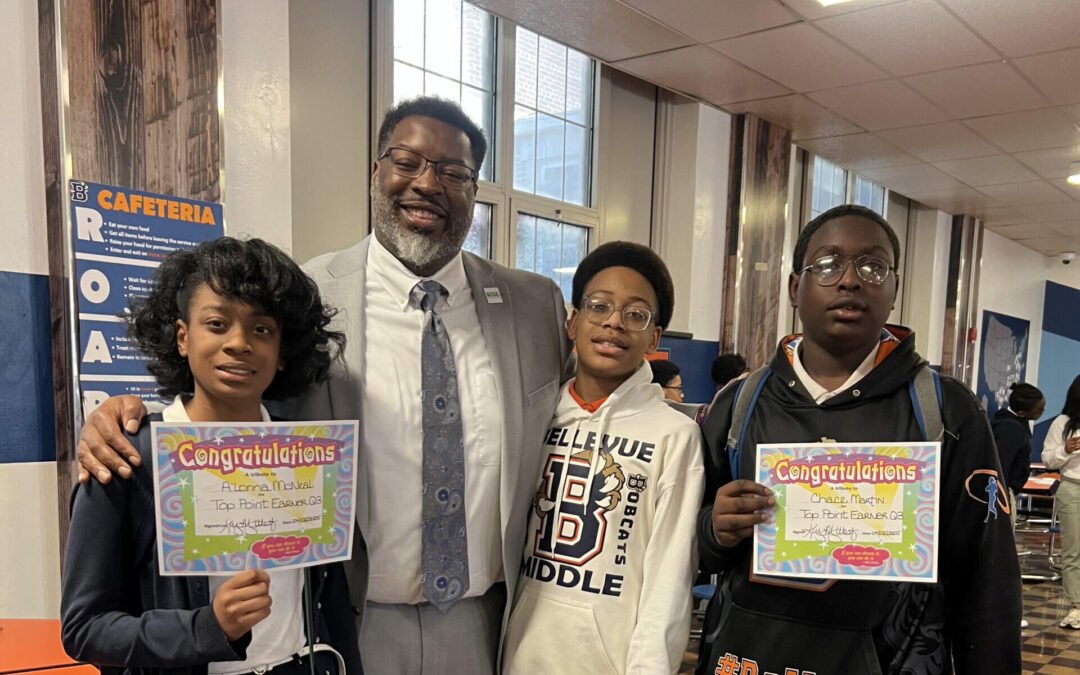

- We need financial education in schools. Teaching students about credit, debt, and saving before they enter the workforce can change their financial trajectory for life. RISE is already taking steps in this direction through our Goal Card program, which helps students set financial and academic goals, track progress, and develop strong financial habits early. By empowering young people with these skills now, we can help them avoid common financial pitfalls and set them on the path to economic stability.

- We need better policies that support economic mobility. From fair lending practices to stronger financial protections, policymakers must ensure that everyone, especially historically marginalized communities, has a fair shot at financial success.

- We need businesses and organizations to step up. Employers can provide financial wellness programs for their employees, and community organizations can partner with financial education initiatives to ensure more people get access to resources.

- We need livable wages and workforce development opportunities. Without jobs that pay a fair wage, even the best financial knowledge won’t be enough to help families stay out of poverty.

- We need YOU to take action. Whether it’s attending a free financial coaching session, teaching your kids about money, or supporting organizations like RISE Memphis, everyone has a role in making financial empowerment a priority.

Now is the time to come together and act for financial empowerment

The financial challenges we face as a community aren’t going to disappear on their own. But together, we can ensure that Memphis becomes a city where financial literacy is the norm, not the exception.

At RISE Memphis, we believe that financial knowledge is power. It’s the power to change lives, strengthen families, and build a future where financial stability isn’t just a dream − it’s a reality for all.

This Financial Literacy Month, commemorated in April, let’s commit to making financial empowerment more than just a buzzword. Let’s make it a movement.

Malcom Rawls is executive director of RISE Memphis. To learn more about RISE Memphis and how you can get involved, visit www.risememphis.org or follow us on social media @risememphis.

Recent Comments